Check your credit score: Why it's important and how to do it

What is a credit score?

A credit score is a number that represents the creditworthiness of an individual. Lenders use it to determine whether or not to extend credit to a borrower and at what interest rate. A high credit score indicates that a borrower is likely to repay their debt, while a low credit score suggests that a borrower is more likely to default on their loan.

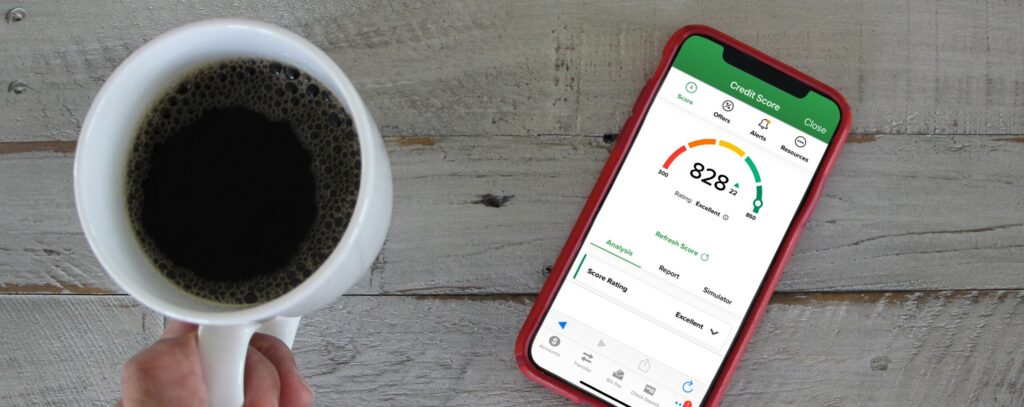

Credit scores are calculated using a variety of factors, including payment history, outstanding debt, and length of credit history. The most common type of credit score is the FICO score, which ranges from 300 to 850. A score of 700 or above is considered good, while a score below 600 is considered poor.

How to check your credit score?

The different types of credit scores

There are many different types of credit scores. The most common type of credit score is the FICO score and the VantageScore.

The VantageScore is another type of credit score that’s becoming more popular with lenders. Like the FICO score, it considers your payment history, credit utilization, and length of credit history. However, it also considers factors like recent inquiries and total debt.

The FICO score is the most widely used credit score. Lenders use it to determine your creditworthiness. A high FICO score means you’re a low-risk borrower, which could lead to a lower interest rate on loan. Conversely, a low FICO score could lead to a higher interest rate and could mean you won’t be approved for a loan at all.

How is your credit score calculated

Your FICO score is a key factor in determining the interest rate you’ll pay on a loan and whether you’ll be approved for a loan. So how is your FICO score calculated?

Five main factors go into your FICO score: payment history (35%), credit utilization (30%), length of credit history (15%), a mix of credit accounts (10%), and new credit accounts (10%).

How your credit score affects your life?

A good credit score is v for many reasons. It can help you get a loan, rent an apartment, and even get a job. On the other hand, a bad credit score can make life more difficult and expensive. Here are some ways your credit score affects your life:

Getting a Loan: If you have a low credit score, you may not be able to get a loan at all, or you may have to pay a higher interest rate. This can make it challenging to buy a car or a house.

Renting an Apartment: Many landlords check your credit score before renting an apartment. If your score is low, they may refuse to rent to you or charge you a higher security deposit.

How many times should you check your credit score?

Your credit score is one of the most important pieces of your financial puzzle. It’s a number that lenders look at to determine your creditworthiness and can impact everything from the interest rate you’re offered on loan to whether or not you’re approved for a mortgage. So, how often should you check your credit score?

Your credit score is one of the most important pieces of your financial puzzle. It’s a number that lenders look at to determine your creditworthiness and can impact everything from the interest rate you’re offered on loan to whether or not you’re approved for a mortgage. So, how often should you check your credit score?

The answer may surprise you. Checking your credit score too often can have a negative impact on your score. That’s because each time you check your score, it’s recorded as an inquiry on your credit report. And too many inquiries can hurt your score. So, how often should you check your credit score? The best practice is to check it once a year.

Wrap Up:

Checking your credit score is important because it gives you an idea of where you stand financially. It also allows you to see if there are any negative items on your report that you need to address. Set up a consultation with us for your credit score needs.